The Best Strategy To Use For Home Equity Loan copyright

Table of ContentsHome Equity Loan copyright Things To Know Before You BuyHome Equity Loan copyright Can Be Fun For EveryoneThe Only Guide to Home Equity Loan copyrightThe Basic Principles Of Home Equity Loan copyright

Fixed-rate home equity finances give one lump amount, whereas HELOCs provide borrowers revolving lines of credit score. Investopedia/ Zoe Hansen Basically, a home equity finance is similar to a home loan, hence the name second home mortgage.Standard home equity loans have actually a set repayment term, just like conventional home mortgages. The customer makes routine, fixed repayments covering both primary and passion. As with any type of home loan, if the financing is not paid off, the home might be offered to satisfy the remaining financial debt. A home equity lending can be an excellent way to transform the equity you've accumulated in your house into cash money, especially if you spend that money in home remodellings that boost the value of your home (Home Equity Loan copyright). Ought to you want to transfer, you may finish up losing money on the sale of the home or be unable to relocate., stand up to the temptation to run up those credit history card bills again.

Before signingespecially if you're making use of the home equity finance for financial obligation loan consolidationrun the numbers with your bank and ensure that the loan's regular monthly settlements will certainly without a doubt be reduced than the mixed repayments of all your current responsibilities. Also though home equity loans have lower rates of interest, your term on the brand-new funding might be longer than that of your existing financial obligations.

Little Known Questions About Home Equity Loan copyright.

Home equity loans give a single lump-sum repayment to the consumer, which is paid back over a set duration of time (normally five to 15 years) at an agreed-upon passion rate. The settlement and rate of interest rate stay the very same over the life time of the finance. The lending needs to be paid back in full if the home on which it is based is sold.

If you have a stable, reputable resource of income and understand that you will be able to pay back the financing, then low-interest rates and feasible tax obligation deductions make home equity financings a reasonable option. Getting a home equity finance is rather simple for many customers due to official website the fact that it is a protected financial obligation.

The rates of interest on a home equity loanalthough more than that of a very first mortgageis a lot lower than that of charge card and various other customer loans. That aids clarify why a primary factor that customers borrow against the value of their homes by means of a fixed-rate home equity loan is to settle bank card equilibriums.

4 Simple Techniques For Home Equity Loan copyright

Recognize that the passion paid on the part of the loan that is above the value of the home is never tax insurance deductible (Home Equity Loan copyright). When getting a home equity car loan, there can be some lure to borrow even more than you quickly need since you just obtain the payment when and do not know if you'll receive one more lending in the future

Say you have an auto financing with an equilibrium of $10,000 at an interest price of 9% with 2 years remaining on the term. Combining that financial debt to a home equity finance at a rate of 4% with a term of five years would actually cost you more cash if you took all 5 years to repay the home equity car loan.

Defaulting can cause its loss, and shedding your home would be significantly more catastrophic than surrendering an automobile. A home equity financing is a finance for a set quantity of cash, settled over a collection amount of time that utilizes the equity you have in your home as collateral for the finance.

The Ultimate Guide To Home Equity Loan copyright

, look at these guys making a list of to subtract the rate of interest paid on a home equity car loan might not lead to cost savings for the majority of filers.

This indicates that the overall of the equilibriums on the mortgage, any type of existing HELOCs, any type of existing home equity loans, and the brand-new home equity lending can not be greater than 90% of the appraised value of the home. Somebody with a home that assessed for $500,000 with an existing mortgage equilibrium of $200,000 could take out a home equity lending for up to $250,000 if they are approved.

Home equity is the portion of your home that you possess. You may require to obtain a home appraisal to determine the worth of your home. Home equity is the difference between your home's appraised value and exactly how much you owe on: your home loan your home equity line of credit history (HELOC) other finances and lines of credit rating protected by your home For instance, mean your home is worth $250,000, and your mortgage balance is $150,000.

Judge Reinhold Then & Now!

Judge Reinhold Then & Now! Val Kilmer Then & Now!

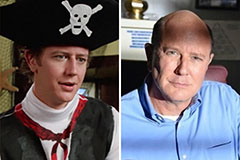

Val Kilmer Then & Now! Charlie Korsmo Then & Now!

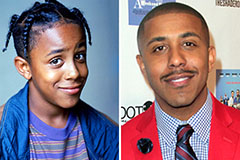

Charlie Korsmo Then & Now! Marques Houston Then & Now!

Marques Houston Then & Now! Traci Lords Then & Now!

Traci Lords Then & Now!